Waste Connections (WCN) posted its first-quarter financial results on April 28 after market close. The North American integrated waste services company reported better-than-expected results driven by strong growth in solid waste pricing, accelerating solid waste volumes, and increased resource recovery values.

Waste Connections’ revenue came in at $1.396 billion in the quarter ended March 31, an increase of 3.3% from $1.352 billion in the first quarter of 2020. Adjusted EBITDA was $433.2 million in 1Q 2021 compared to $408.5 million in the prior-year period.

Net income was $160.3 million ($0.61 per share), compared to $143 million ($0.54 per share) in the previous year’s quarter. Waste Connections earned $0.70 per share in the first quarter, up 7.7% from $0.65 per share a year ago on an adjusted basis. The consensus estimate was for EPS of $0.66 on revenue of $1.37 billion.

Waste Connections’ President and CEO Worthing F. Jackman said, “We are extremely pleased by the increasing momentum throughout the first quarter, with high flow through from returning solid waste volumes and increased resource recovery values setting up for outsized performance in 2021.”

“Solid waste activity further accelerated as we exited the first quarter, positioning us for an expected double-digit solid waste price plus volume growth in the second quarter,” added Jackman. (See Waste Connections stock analysis on TipRanks)

Three weeks ago, Goldman Sachs analyst Jerry Revich launched coverage of WCN with a Buy rating and a $124.00 (C$153.92) price target for a 5.8% upside potential. Revich stated, “Every ton of trash is 20% to 25% more profitable for public companies today than in 2008.”

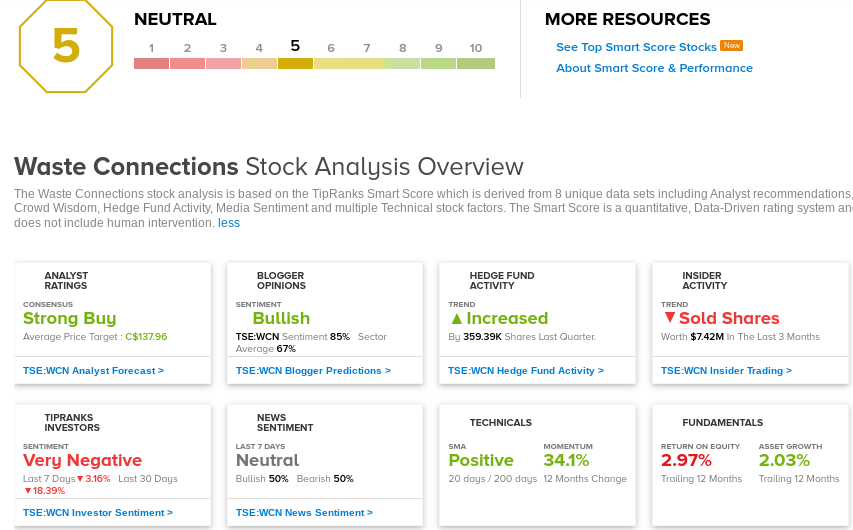

Overall, the consensus on the Street is that WCN is a Stong Buy based on 7 Buys. The average analyst price target of C$137.96 implies a downside potential of about 4.4% from current levels. Shares have risen by about 20% over one year.

However, WCN scores a 5 out of 10 on the TipRanks Smart Score rating system, indicating that the stock could perform in line with the overall market.

Related News:

Teck Resources 1Q Revenue And Earnings Beat Estimates; Shares Plunge 3%

CGI’s Profit Rises To C$341.2M In 2Q

TFI International Posts Better-Than-Expected Results In 1Q