- Silver struggled to capitalize on the previous day’s positive move to two-week tops.

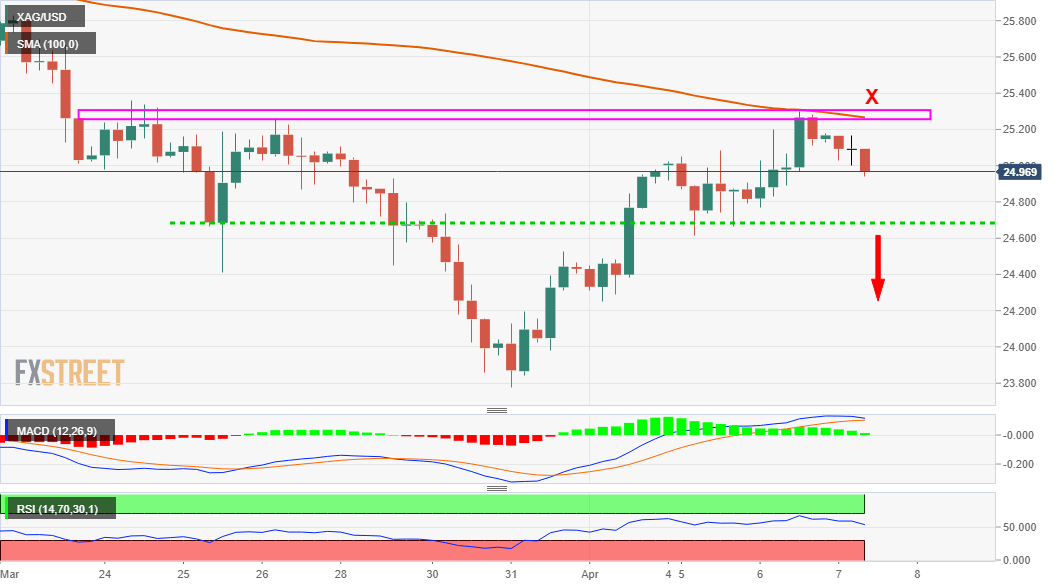

- The emergence of fresh selling near the $25.30 supply zone favours bearish traders.

- Bearish oscillators on the daily chart add credence to the near-term negative outlook.

Silver witnessed some selling through the first half of the trading action on Wednesday and eroded a part of the previous day’s positive move to two-week tops. The commodity was last seen trading just below the $25.00 psychological mark, down 0.80% for the day.

The XAG/USD once again struggled to make it through the $25.30 supply zone and for now, seems to have stalled its recent recovery move from YTD lows. The mentioned barrier should now act as a key pivotal point for traders and help determine the near-term trajectory.

Meanwhile, technical indicators on the daily chart are still holding in the bearish territory and have just started gaining negative momentum on the 1-hour chart. Given repeated failures near the mentioned barrier, the set-up supports prospects for further losses.

From current levels, weekly swing lows, around the $24.60 region now seems to protect the immediate downside. Some follow-through selling now seems to accelerate the fall towards the $24.00 mark before the XAG/USD eventually drops to the $23.80-75 region (YTD lows).

On the flip side, bulls are likely to wait for a sustained move beyond the $25.30 strong barrier before positioning for any further gains. The XAG/USD might then surpass an intermediate resistance near the $25.55-60 region and aim to reclaim the $26.00 mark.