U.S. equities climbed to all-time highs after a batch of corporate earnings and economic data showed the American economy gained steam in the first three months of the year.

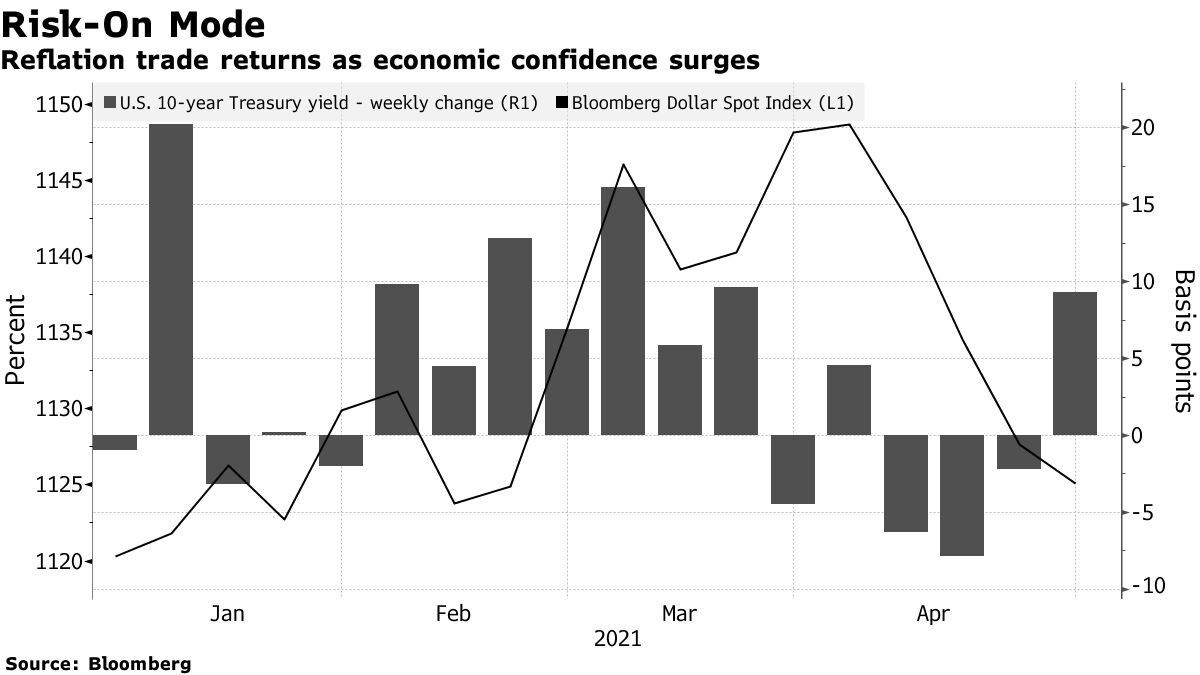

U.S. gross domestic product expanded at a 6.4% annualized rate in the first quarter, according to the Commerce Department. The S&P 500 traded at fresh record. Apple Inc. and Facebook Inc. rallied after their earnings results surged past Wall Street’s estimates, helping push the Nasdaq 100 to an all-time high. The 10-year U.S. Treasury yield was on track toward its biggest weekly increase since early March.

While the GDP figures may support the Federal Reserve’s strong assessment of the economy, the central bank is in no mood to halt aggressive support as it looks for even further progress in employment and inflation. Chair Jerome Powell on Wednesday dismissed worries about price surges or anecdotes of labor shortage, implying the central bank is prepared to run the economy hot for a while. President Joe Biden unveiled a $1.8 trillion spending plan targeted at American families, adding to the economic optimism.

“The economic recovery is on firm footing,” said Keith Lerner, chief market strategist at Truist Advisory Services. “As we move into the summer months as we more fully reopen, I think the economy is still spring-loaded into the second half.”

With their plans, the Fed and Biden have delivered a boost to investor sentiment that had see-sawed in recent days between optimism over a string of robust economic data and caution amid high valuations and speculation about stimulus tapering by year-end. A separate report on Thursday showed applications for U.S. state unemployment insurance fell last week to a fresh pandemic low as more Americans get vaccinated and return to work.What’s moving marketsStart your day with the 5 Things newsletter.EmailSign UpBy submitting my information, I agree to the Privacy Policy and Terms of Service and to receive offers and promotions from Bloomberg.

Facebook surged the most in five months after it posted sales that dwarfed estimates on the back of a 10% growth in active users. Apple snapped a two-day losing streak after its quarterly revenue crushed expectations on strong sales of the 5G iPhone 12 line, iPads and Macs. Merck & Co. slipped fell the most since January after posting earnings below expectations as a surge in Covid-19 deterred many patients from seeking routine care.

In Europe, the benchmark Stoxx 600 gauge moved closer to a record reached earlier in April. Personal-care shares climbed after Unilever delivered a sales beat and announced a share buyback. Oil giants Total SE and Royal Dutch Shell Plc boosted their sector after reporting better-than-forecast profits.

Crude oil extended gains on a confident outlook on demand from OPEC and its allies, despite the threat from India’s Covid-19 crisis. Copper rose for a fifth day. The Bloomberg Commodity Index increased for a ninth day, nearing a three-year high on a closing basis.

You have to wonder why Obama/Bernanke/Yellen/Powell didn’t turn on the printing press even earlier? Since M2 Money Velocity fell in Q1 despite the 6.4% GDP print to near the all-time low.

What happens when Powell and the gang decide to take away the punch bowl? Or Biden stops with multi-trillion dollar spending ideas?

Powell is the God of Hellfire along with Biden.