Small-caps are having a moment.

After years of underperformance, companies with a smaller market capitalisation are rising faster than the bigger, blue-chip names that make up America’s mainstream stock indices.

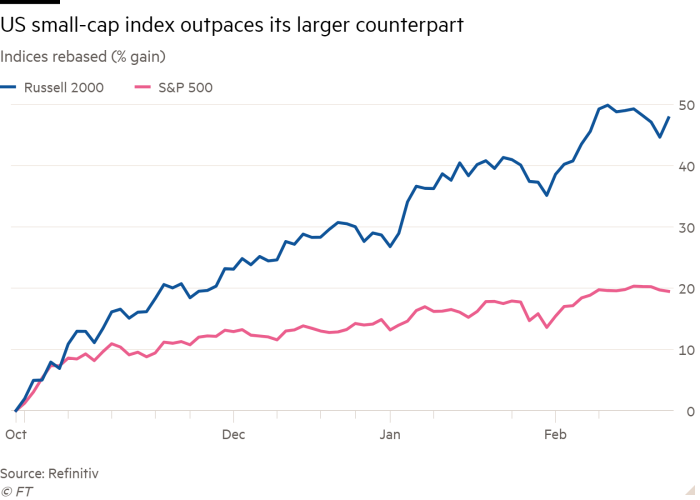

The Russell 2000 index of smaller US-listed companies is up by more than 47 per cent since the start of November, when markets began to shoot higher on vaccine optimism, and has advanced 15 per cent year to date. By comparison, the benchmark S&P 500 is up 19.5 per cent since November and 4 per cent this year.

For months during the pandemic, investors favoured fast-growing tech stocks that were the winners of a shift towards working and shopping online. Smaller companies, whose performance is generally more exposed to traditional consumer trends and more closely tied to economic growth, suffered.

But November’s Covid-19 vaccine breakthroughs prompted investors to shift towards cyclical stocks, lifting the Russell 2000. “Since November, investors have started to see the light at the end of the tunnel and think about the world post-lockdowns,” said BlackRock portfolio manager Russ Koesterich.

Recovery hopes gave the opportunity to investors “sniffing” a rebound for small-caps, said Liz Ann Sonders, chief investment strategist at broker Charles Schwab.

Sonders pointed to the proportion of Russell 2000 companies that were not profitable, a share that reached 45.2 per cent in October. “In past cycles it was a good entry point — at the point, ironically, that lack of profitability was at its peak,” she said.

The Russell 2000 is also expected to benefit from the boost to banks from a relative rise in long-term interest rates, which increases the gap between what lenders can charge borrowers and what they pay for funding.

The Russell 2000 is more heavily weighted to financial stocks at about 14 per cent — compared with about 10 per cent for the S&P 500, according to data from the index providers. The small-cap index also leans more towards regional banks that are exposed to traditional lending, while the larger financials on the blue-chip index have a greater bias to trading and investment banking.