Investors have moved to protect themselves against further falls in the value of Ark Investment Management’s flagship fund, a key vehicle for everyday investors betting on Tesla and other high-growth stocks.

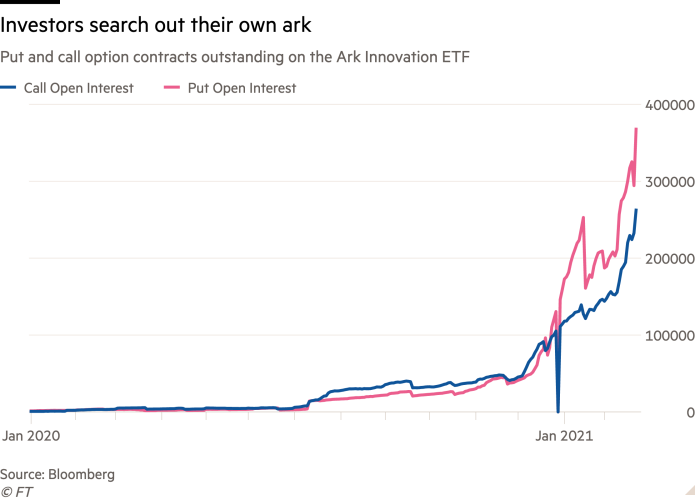

The number of put options outstanding on the ARK Innovation exchange-traded fund — which would pay off if the ETF’s price declines — has hit a high of 368,000 contracts, according to Bloomberg data.

The volume of put contracts has also regularly surpassed call options purchased on the Innovation ETF, in a sign investors are keen to hedge themselves against a fall in the $25bn fund’s value. One of the most actively traded contracts on Wednesday would turn a profit if the fund fell to $115 a share — a 17 per cent decline from Tuesday’s close.

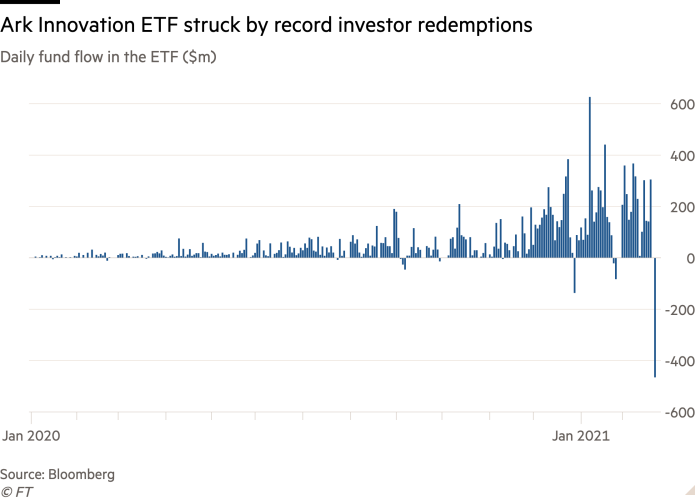

Investors built up the options positions as the ARK Innovation ETF, known by the ticker symbol ARKK, suffered a record $465m outflow on Tuesday. More than $5bn of the ETF changed hands on Tuesday — doubling the previous daily record — amid a nascent sell-off in technology shares.

The withdrawals also hit other popular funds run by Ark, which was founded by money manager Cathie Wood in 2014. The group’s next generation internet ETF suffered redemptions of $119m while the company’s genomic revolution ETF posted outflows of $202m on Tuesday, according to data from Bloomberg.

Ark’s stock market positions have come under threat as US interest rates have moved higher, threatening the high valuations of shares in faster-growing technology companies.

“People are looking at these lofty levels for downside protection,” said George Catrambone, the head of Americas trading at asset manager DWS. “It’s a natural pause and people are a little more cautious.”

Short interest also has been climbing in the Innovation ETF as investors bet it could face a correction, according to data provider S3 Partners. Roughly 6.55m of the ETF’s shares have been borrowed for short sales, a figure which has climbed by more than 1.5m shares over the past month.

“This is a function of people being very concerned about high-flying names in general, in which Tesla is the poster child,” said Amy Wu Silverman, a derivatives strategist at RBC. “At some point valuation does matter. People have been concerned with rate increases for a while . . . and that’s bleeding into a lot of these tech names.”

Wood has dismissed the notion that the rally in the US stock market is akin to a bubble, telling the Financial Times this month that she would use any correction in share prices to buy more “high conviction names”.

The flagship Ark ETF has become a retail investor favourite over the past year. Overall, the size of the group’s holdings has swelled from about $3bn to a recent peak of $60bn in the past year.

“They have been able to deliver astonishing returns over the past one-year period,” said Kelly Ye, director of research at IndexIQ, the ETF platform for New York Life Investments. But she added that investors are becoming “more and more aware” of the valuation challenges to high-flyers like Tesla.

Tesla accounted for 9.7 per cent of the Innovation ETF on Tuesday, with streaming hardware provider Roku; payments company Square; streaming music provider Spotify; and virtual health company Teladoc Health approaching a further 20 per cent of the fund.

Wood doubled down on her Tesla bet this week. Ark funds bought more than $160m of Tesla shares as the electric vehicle maker’s stock price tumbled as much as 13.4 per cent.

“There is much more money in their strategies and they have shifted to increasing their exposure to large-cap stocks,” said Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research.