We are living in extraordinary times. As if a global pandemic wasn’t enough to deal with, last week’s deadly storming of the Capitol set the stage for a historic second impeachment.

The attack on democracy has had other implications. Possibly worse for Trump than the impeachment charge, has been the removal of his favorite toy. Following the Trump inspired riots, Twitter (TWTR) suspended his account for 24 hours. On Friday, the social media platform made the ban permanent, after it became clear the lame duck president has no intention of cutting back on the incendiary language even after the suspension.

Whether justified or not, Wells Fargo analyst Brian Fitzgerald believes that such actions could result in an “engagement headwind.”

“Regardless of one’s opinion of the President or TWTR’s recent policy actions,” the 5-star analyst said, “We view Trump as a unique animating force for activity and engagement on the platform that will not be easily replaced. The leader of the U.S. government, and by extension ‘the free world,’ using the platform as a medium for stream-of-consciousness-style expression and real-time policy proclamations on a daily basis has surely represented a proprietary platform advantage for TWTR, now gone.”

According to a 2018 Gallup survey, Trump’s tweets are either seen, heard, or read by 73% of Americans. The same survey also noted that among the 26% of Americans who had a Twitter account, the @realDonaldTrump account was followed by 8%, 4% said they read all or most of his tweets and some of his ramblings were read by 2%.

Fitzgerald estimates that at least 20% of Twitter’s U.S. audience “has material levels of engagement with Trump’s tweets or related content.”

However, there could be also be upside to Twitter’s drastic move. The constant controversy surrounding Trump has had plenty of stakeholders on edge and his removal could put many at ease.

“With the matter resolved,” Fitzgerald summed up, “We believe that management and employees may be able to focus more squarely on key product and strategy issues and rebuild lost TWTR engagement from a more sustainable/diversified base.”

All in all, the ban has resulted in a slashed price target; the figure drops from $47 to $43 and suggests 9% downside from current levels. Fitzgerald’s rating stays an Equal Weight (i.e. Hold) (To watch Fitzgerald’s track record,click here)

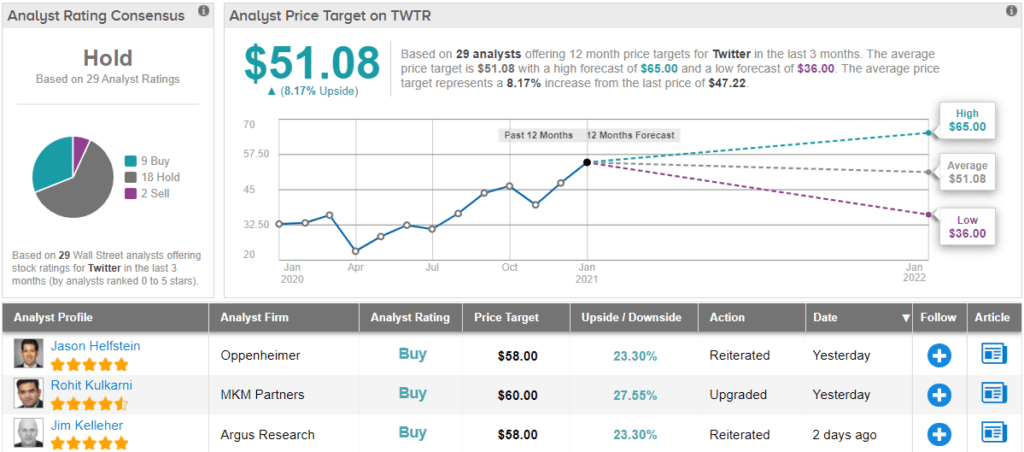

The majority of the Street sides with the Wells Fargo analyst’s cautious take on the microblogging platform, as TipRanks analytics demonstrate TWTR as a Hold. This is based on 9 Buy ratings, 18 Holds and 2 Sells issued over the past 3 months. With a potential upside of ~8%, the average price target stands at $51.08. (See TWTR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.