Rolls-Royce has warned that cash outflows will be more than double the expected level as global travel restrictions cut into flying times. But the company stuck with a forecast to turn cash flow positive during the second half of the year.

The jet engine maker said that it now expected a cash outflow of around £2bn in 2021 — much worse than a consensus forecast for a £864m outflow. Engine flying hours will be around 55 per cent of 2019 levels this year, versus a previous base-case forecast given in October of 70 per cent.

But cost savings meant year-end liquidity was approximately £9bn, at the upper end of the previously guided range. “We are confident that despite the more challenging near-term market conditions we are well-positioned for the future,” Rolls said in a trading update.

Briefly

JD Sports confirmed it is looking at additional funding options including a potential equity placing with a view to increasing its flexibility to invest in future strategic opportunities. Sky News reported on Monday that JD Sports was considering a placing in the region of £400m to bolster its acquisition war chest.

Crest Nicholson said it will restart dividend payments at the 2021 half year. The housebuilder reported an adjusted profit before tax for its fiscal year ending October of £45.9m, down 62 per cent on the previous year but slightly ahead of its previous guidance. Trading had been good since the spring lockdown and reservation levels this month were in line with expectations, it said.

Forterra, Britain’s second biggest brickmaker, said positive feedback from customers and a steady improvement in trading over the second half gave growing cause for optimism. But Brexit and the reduction in government housing market subsidies meant the picture for demand remained unclear, Forterra said. The company nudged earnings guidance slightly higher, saying in a trading update that 2020 ebitda before exceptional items will be around £37m versus a previous target of at least £34m.

Sandwich maker Greencore posted a 15 per cent fall in revenue for its first quarter, which ended on Christmas Day, as its food-to-go and ready meal categories both suffered declines. The company said group revenue is currently 20 per cent below prior year levels on lockdown restrictions, with food-to-go down 35 per cent and convenience products holding steady.

Talks for a deal between the ownership group behind Liverpool FC and a blank-cheque company led by Moneyball executive Billy Beane have fallen apart, people briefed on the matter told the FT. They said Fenway Sports Group, controlled by billionaire John Henry, was instead in discussions to sell a minority stake to RedBird Capital, a private investment firm founded by former Goldman Sachs veteran Gerry Cardinale.

Fund manager Quilter reported assets under management and administration of £117.8bn at the end of December, up 7 per cent year on year, with growth supported by improved net flows and positive market movement.

Saga, the over 50s insurer and cruise operator, said it expects to have remained profitable on an underlying basis last year and that liquidity remains strong. Cash burn in its travel business for the second half was towards lower end of previous guidance of £6m to £8m per month, Saga said.

PZ Cussons said it remained on track to match expectations, in spite of higher raw material costs and the risk of weakening consumer confidence. Half-year results from the maker of Imperial Leather soap showed sales growth from continuing operations of 10.2 per cent to £312.9m. Underlying adjusted profit for the six months ended November rose 16.4 per cent to £27m.

Irn Bru maker AG Barr said revenue for the year ended January 24 will be marginally ahead of previous guidance at £227m, versus £255.7m in the previous year. Second-half trading had been at the upper end of plans until new lockdowns took effect, the drinks maker said.

Beyond the Square Mile

Swiss bank UBS on Tuesday pledged to return billions to shareholders as surging income for the world’s super wealthy led to a sharp rise in profits last year, despite the global pandemic. The bank reported net profits attributable to shareholders of $6.6bn for 2020, up 54 per cent year-on-year and well ahead of expectations. Return on core equity tier one capital — a key measure of the bank’s financial strength — was 17.6 per cent, compared to a targeted range of 12-15 per cent.

Leon Black is to step aside as chief executive of Apollo Global Management, the company announced on Monday, as it revealed he had made far larger payments than previously known to the late paedophile Jeffrey Epstein. Mr Black, who founded Apollo in 1990, paid $158m to Epstein over a five-year period ending in 2017, according to a report by the law firm Dechert.

Companies launched a $400bn fundraising blitz in the first three weeks of 2021 as the torrent of government and central bank stimulus to rescue global economies cascaded across capital markets. The global bond and equity fundraising spree marks one of the biggest hauls of the past two decades for the comparable period and is about $170bn above the average for this time of year, a Financial Times analysis of Refinitiv data shows.

Essential comment before you go

Eric Platt

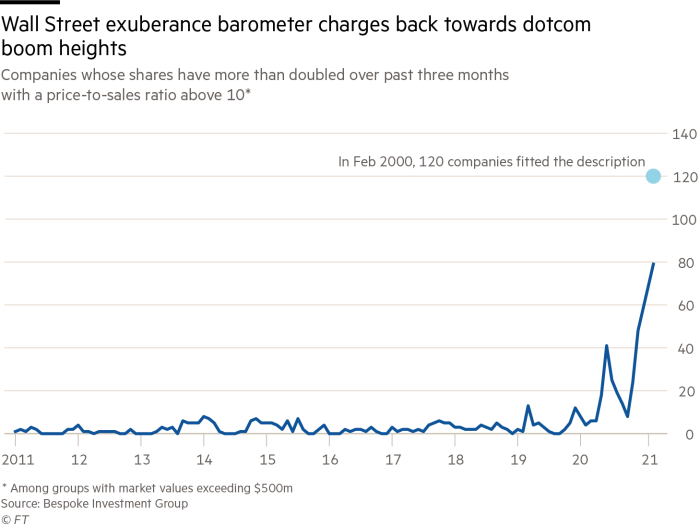

Shares in 79 companies listed on US stock exchanges have more than doubled in the past three months and are all part of the “ludicrous index” created by Bespoke Investment Group. This article is part of a new series entitled Runaway Markets.

Lombard

The pandemic gets the blame for the sale of Debenhams and likely purchase of Topshop-owner Arcadia to online rivals Boohoo and Asos respectively, but both retailers had underlying conditions before Covid-19 came along stemming from over-enthusiastic cash extraction.

Thanks for reading. Feel free to forward this email to friends and colleagues, who can sign-up here.