Oklahoma’s gross receipts to the Treasury fell 3.8% in 2020 amid the coronavirus pandemic, high unemployment and falling oil prices, state Treasurer Randy McDaniel said.

The report comes a month before lawmakers meet in Oklahoma City to allocate $8.46 billion in spending for the fiscal year that begins July 1.

Collections from all sources in calendar year 2020 reached $13.19 billion, down by $520.9 million, or 3.8%, from calendar year 2019, McDaniel said. Gross receipts from December of $1.16 billion were 0.4% or $4.8 million below December receipts from a year ago.

“The state’s economy declined in 2020, but was bolstered by the resourcefulness of Oklahomans,” McDaniel said. “The state has exceeded expectations during a year most of us would like to forget. Hopefully, we will see improvement in the months ahead as the vaccine becomes widely available.”

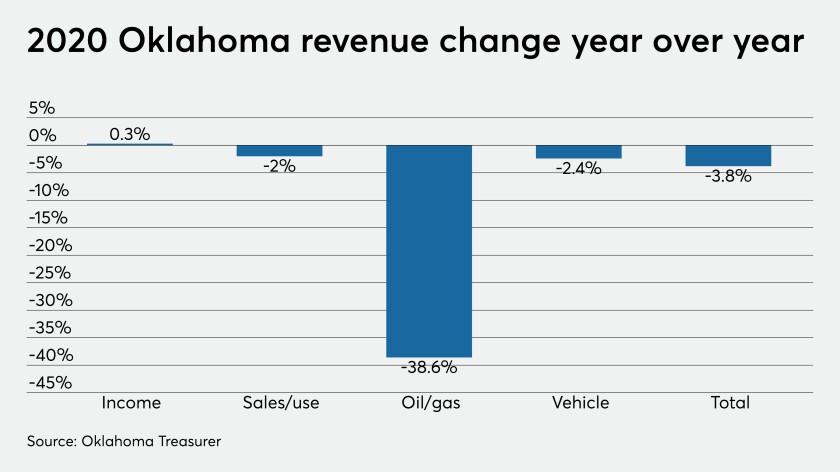

During the past year, the gross production tax on oil and gas took the biggest hit — down by almost 40% or $400 million.

The other major revenue streams, including income, sales and use, and motor vehicle taxes, remained mostly flat, McDaniel said.

Individual income tax was down less than 2% for the year, while sales tax shrank by almost 4%. Motor vehicle taxes also were down for the year by more than 2%.

Corporate income tax collections rose 15%, and use tax on out-of-state purchases increased by 10%.

During December, gross production taxes fell 18.6% while combined income tax slipped 0.8%.

Combined sales and use tax collections for the month grew by 3.6%, due primarily to almost 30% growth in use tax receipts, McDaniel said.

The unemployment rate in Oklahoma was 5.9% in November, according to the U.S. Bureau of Labor Statistics. The state’s jobless rate is down from 6.1% in October, but up from 3.4% in November 2019. The seasonally adjusted number of Oklahomans listed as jobless was reported as 109,364.

The U.S. unemployment rate was 6.7% in November.

The Oklahoma Business Conditions Index in December rose above growth neutral after dipping in November. The December index was set at 55.9, compared to 49.4 in November. Numbers above 50 indicate economic expansion is expected during the next three to six months.

The General Revenue Fund, the state’s main operating account, receives less than half of the state’s gross receipts with the remainder paid in rebates and refunds, remitted to cities and counties, and apportioned to other state funds.

In December, A state panel led by Gov. Kevin Stitt certified on that Oklahoma lawmakers will have $8.46 billion to spend on next year’s budget, an increase of more than 8% from the current year’s spending plan. State finance officials told Stitt and other members of the Board of Equalization that the state’s financial picture has improved since they last met in April, when the coronavirus pandemic forced businesses to close and oil and natural gas prices had plummeted.

“By these projections, we now believe we will see less than half the revenue losses predicted in April,” Stitt said in a statement. “Moving forward, the Legislature will still have difficult decisions to make regarding the budget, but my team is committed to working alongside our legislators to ensure we remain fiscally responsible with Oklahomans’ hard earned tax dollars.”

Stitt will use the $8.46 billion figure to build his proposed budget that he will present to lawmakers in February. The board will meet again that month to certify the final amount lawmakers will have to spend on the budget for the fiscal year that begins July 1.

While lawmakers will have an estimated $631 million more to spend this year, they will also have to make up for about $1 billion in one-time revenue sources that were used to build this year’s budget that won’t be available next year. Legislators drew on the state’s rainy day fund and diverted payments to the state’s public pension systems and a road and bridge program to limit agency budget cuts to roughly 4%.