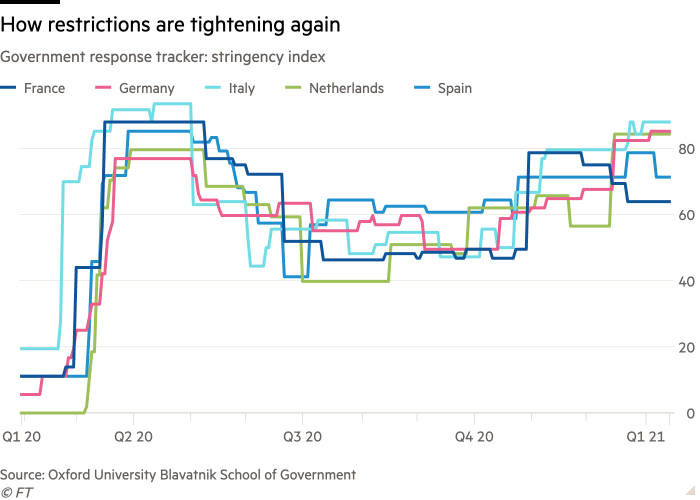

Eurozone nations’ escalating restrictions to tackle the coronavirus pandemic have significantly slowed economic activity, fuelling fears that the bloc faces a double-dip recession, according to widely watched and timely alternative data indicators.

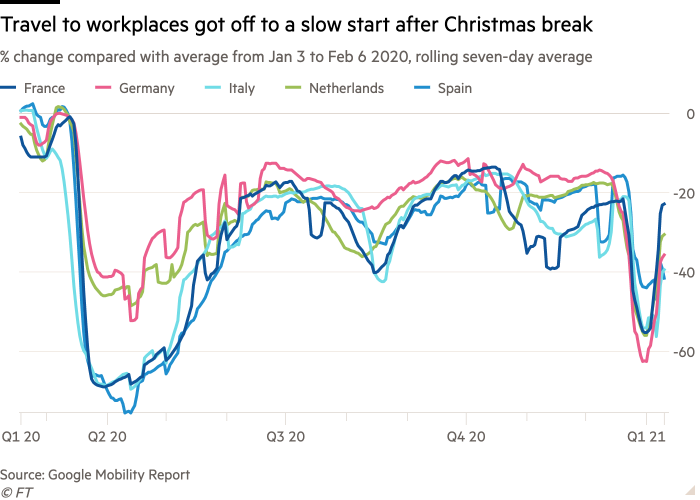

Travel to retail and hospitality venues and workplaces, as well as consumer confidence and spending, have all taken a hit in the first weeks of 2021, according to high-frequency activity trackers. These indicators offer a more timely gauge of the economy than official statistics, although they are less comprehensive and reliable.

Bert Colijn, senior eurozone economist at ING, said early data suggested that, since the start of the year, “activity continues to trend lower”.

In contrast to the sudden, deep shock that the eurozone economy experienced last spring when the pandemic first hit, the new surge in infections was “dragging on for longer”, causing a slower but “steady decline in activity” that increased “the risk of a delayed wave of bankruptcies if generous [government and central bank] support measures do not stay in place”, Mr Colijn said.

As a result, economists anticipate that the estimated fall in output in the eurozone in the final three months of 2020 — Oxford Economics and Nomura forecast a contraction of between 1.8 per cent and 2.3 per cent — will be followed by another drop in the first quarter of 2021 in many of the bloc’s major economies, including Germany and Italy.

That could leave the eurozone in its second recession, defined as two consecutive quarters of negative growth, in less than two years.

Katharina Utermohl, senior European economist at Allianz, said: “We expect the eurozone economy to kick off 2021 with a double-dip recession, with a second consecutive quarterly GDP contraction [in the first quarter] all but certain following the prolongation and further tightening of Covid-19 restrictions in recent weeks.”

Chiara Zangarelli, European economist at Nomura, said the rollout of vaccines was “encouraging” but as lockdowns lengthened, the outlook for first-quarter eurozone gross domestic product was becoming gloomier.

Daniela Ordonez, an economist at Oxford Economics, said the drop in activity “might be only the beginning of a new phase of deterioration in the bloc’s health situation”, citing the risk that more transmissible variants of the virus could take hold.

The fresh upsurge in cases and restrictions is hitting some nations’ economies that avoided the worst damage last year.

In Germany and the Netherlands restrictions are now harsher than in the first phase of the pandemic, resulting in sharper falls in the number of journeys to shops, bars and restaurants than in other European countries.

German consumer spending in the second week of January was 25 per cent lower than in the same period last year, according to Fable Data, which tracks bank transactions. Spending fell across most consumption categories except for groceries, the company said.

The German central bank’s weekly economic activity index — an experimental measure that draws on high-frequency indicators such as pollution, Google searches and consumer confidence — fell that week for the first time since the summer.

The proportion of German consumers who said now was a bad time to make major purchases rose from 16 per cent in December to 20 per cent in mid-January, according to data from Morning Consult. Consumer confidence was largely subdued across major eurozone economies in the first two weeks of January, the data showed.

One bright spot is the bloc’s manufacturing sector. Eurozone industrial production was surprisingly strong in the autumn, supported by rising exports, so factory output is expected to have cushioned the economy to some degree in the final quarter of last year.

More up-to-date measures of industrial production suggest this resilience has continued into 2021. The mileage logged by German trucks, a proxy for industrial production, is running at above the levels of early January last year, after the usual Christmas dip.

Economists warned, however, that the high level of uncertainty about the economic outlook could ultimately feed through into manufacturing production.

Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics, said: “The recovery in the eurozone manufacturing sector will slow in [the first quarter].”