by John Ward

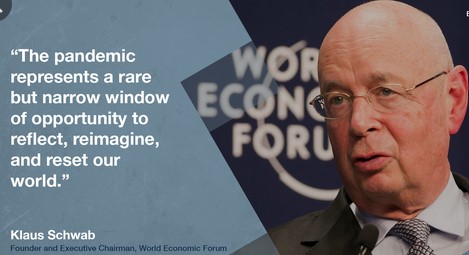

THE COVIDAVOS BUTTON IS ABOUT TO BE PUSHED

In a new online survey released by Ipsos MORI Saturday night,it was revealed that fully 48% of Brits think the current Coronavirus restrictions are not strict enough.

And just to pile on the agony, the number now saying the lockdown strategy is flawed has dwindled to 9%.

Equally clear is that the vast majority of Brits are now clamouring for a vaccine against Covid19 that isn’t a vaccine, and whose so-called trials were a farce.

I am now ringing the loudest alarm bell I can find. For the Free Speech democrats are losing this war, and remain astonishingly uwilling to face facts.

I’ve had the reputation for much of my adult life of being an alarmist. It used to worry me, but I stopped worrying around 2002 after I left corporate life. I left that life because by then, I had made more than enough money from being “an alarmist” to pack it in. Not humungous money off the obscenity scale, but enough. The one odd thing that all highly-paid alarmists discover is that, once the predicted emergency has matured, the world is full of headless ninnies running about asking why “nobody saw it coming”.

I was drawn into the internet commentariat during 2003 after watching Alastair Campbell admit on prime time telly that he’d written lies to destroy David Mellor’s career. He thought his exploit was terrifically funny. The audience laughed. Oh how they laughed. I just felt nauseated.

In 2005, I was swindled out of £50,000 by Scottish Widows. Blair’s Labour was supremely disinterested.

In 2007, I began writing about the poor quality of packaged derivatives. In 2008, I withdrew my SIPP pension from all exposure to the stock markets.

In 2009, I caused a national scandal by revealing Gordon Brown’s personality and eyesight deficiences.

In 2010, I welcomed the Tory/LibDem Coalition, convinced that Nick Clegg would control the Tories. He went out to lunch and then joined Goldman Sachs. (Everyone makes mistakes: I learn from mine.)

In 2011 I picked Mayor Boris Johnson as ‘the most dangerous politician in Britain’. In the same year, I began blogging about Newscorp phone-hacking, calling out Piers Morgan as an early instigator of the practice.

In 2013, I warned Brussels that their snotty rejection of Cameron’s pleas for EU reform would one day fall on their heads. I also called UKIP leader Nigel Farage ‘a politically inept one-trick pony’.

In 2014, I suggested the Labour Party dump Miliband and Balls in favour of more traditional Labour leaders, or they would surely lose the 2015 election.

Immediately after the 2016 referendum, I predicted that NATO, Brussels, the Civil Service, the US State Department and diehard Remain MPs would do everything in their power to usurp the 2016 result. I told UKippers that they were being hopelessly naive in their triumphalism. I was ignored.

In the 2018-19 period, I posted several times that Britain remained ‘on the line’ for debts run up by the eurozone’s European Investment Bank. I also warned that the Withdrawal Agreement would not address this idiocy. It didn’t.

After the 2019 election, I wrote that if Dominic Cummings ever quit the Johnson Administration, it would show that Sedwill, NATO, Wall Street and the Great Resetters were now in charge. In the light of his departure last November, I remain certain that is exactly what has happened.

There are now 20-foot tall neon-light signs that the Secret State in the US has won, the Covid19 propaganda Tsunami is holding sway by bigger and bigger margins….and the 0.1% are ready to apply the picador’s sword to the bull-headed neck.

The International Monetary Fund (IMF) has been out touring the Central Bank capitals of the World, with one overriding message to the governments involved: spend as much as you can while you can, because the Reset is imminent, and debt is irrelevant.

I am far from being the only person cognisant of this development. Those with their ears to the ground will pick up more signs this coming week.

The IMF BSDs have told all the key players that, in the very near future, monetary issuance laws will be changed in over a hundred nations to accommodate the issue of fiat Central Bank Digital Currency (CBDC) around the Globe.

The hour is at hand, people. What are you going to do?

John Ward long ago stopped listening to people who don’t listen, stopped ignoring the evidence of his own ears, eyes and brain, stopped trying to engage with the blind Left, and stopped arguing with the comfortably smug. He spends his spare time studying scared eyes blinking above face masks.