Should you call GameStop’s (GME) astounding run-up this month amazing, or ridiculous? Perhaps “amazingly ridiculous” is a reasonable compromise.

From Jan. 4, the first trading day of the New Year, through Monday’s close, shares of this terminally ill mall-based retailer (Q3 sales — down 30% year-over-year) have shot up 345% in three short weeks. And why is the stock up so much?

Don’t ask me — and don’t ask GameStop, either. The most recent press release from management, dated Jan. 11, described how GameStop grew its same store sales only 4.8% during a Christmas holiday period that featured two new gaming consoles for sale.

Granted, GameStop fans point out that the company isn’t just a mall-based retailer anymore, but leaning into the e-commerce sphere in this Age of Pandemic. Well and good, and e-commerce sales at GameStop did grow 309% year over year during the period. But even so, between the improved SSS and the much better e-commerce sales, GameStop still somehow managed to end up with a total sales decline of 3.1% for the period.

Regardless of how the sales decline happened, though, it’s not looking good for GameStop hitting Wall Street’s target of 4.5% sales growth for the fiscal fourth quarter when it reports in March — and maybe that’s part of the reason that on Monday, Telsey Advisory analyst Joseph Feldman downgraded GME stock from Outperform to Underperform.

Bullish on GameStop since its upgrade to Outperform last September, Feldman says that GameStop’s approximately 970% increase in share price since that rating “far exceeds our high fundamental expectations and projected multi-year benefits of the new gaming cycle.” Rather than being based on fundamentals (which as noted above, are far from wonderful), Feldman surmises that this month’s “sharp surge in GameStop’s share price and valuation likely has been fueled by a short squeeze,” exacerbated by “speculation” on the part of retail investors.

While Feldman is no doubt delighted by how well his recommendation has worked out, therefore, he warns that “the current share price and valuation levels are not sustainable,” and predicts an imminent return to “fair valuation driven by the fundamentals.”

So what might that look like? What is a “fair valuation” for GameStop stock? Feldman predicts that once full-year results are in, GameStop will end fiscal 2020 with $5.1 billion in total sales (down 21% year over year — an improvement from Q3), but still incur a $1.91 per share loss. Unlike most analysts on Wall Street, he sees a rebound in both sales (up 14%) and earnings (positive $0.70 per share) in fiscal 2021, followed by stable sales but continued improvement in earnings ($1.57 per share) in 2022.

Feldman calculates that numbers like these should make GameStop stock worth about $33 a share. This figure suggests that GameStop — currently trading north of $76 a share — will shortly collapse and lose more than half its value. (To watch Feldman’s track record, click here)

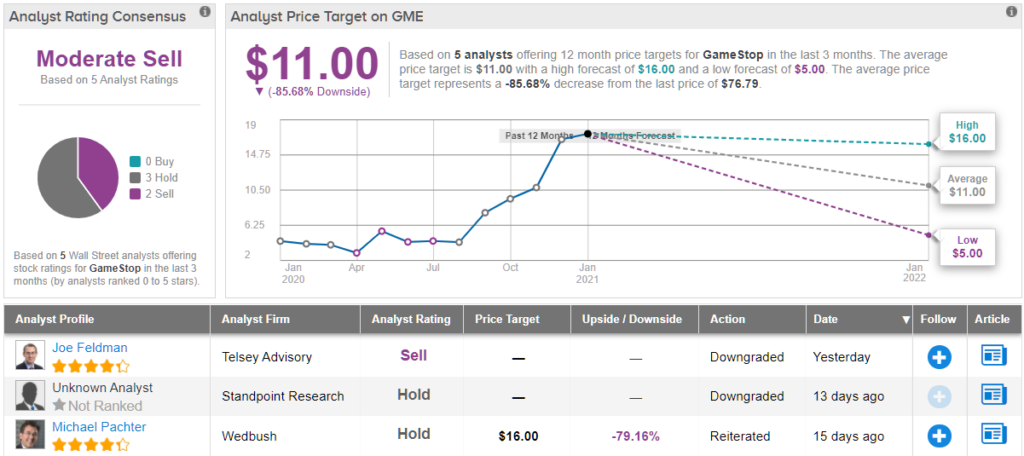

Overall, Wall Street has a very pessimistic outlook on GME right now. Not only does the stock show a Moderate Sell consensus with not a single Buy rating over the past three months, but the current consensus price target indicates ~86% downside from current levels. (See GME stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.