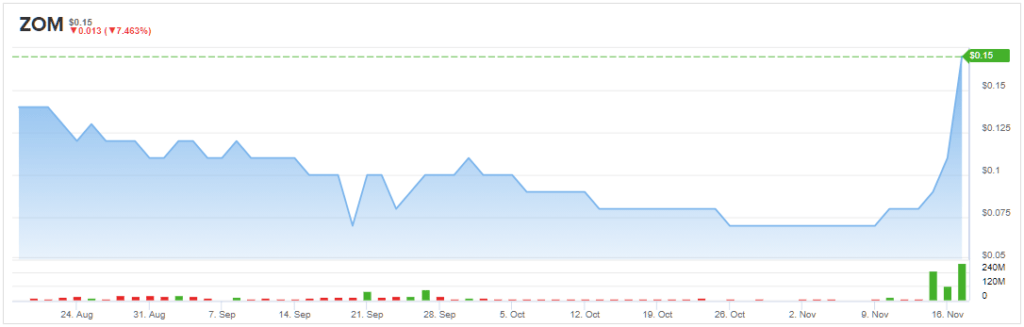

It has been a bountiful November for investors of microcap Zomedica (ZOM). Shares have been on an absolute tear and are up by 120% since the start of the month.

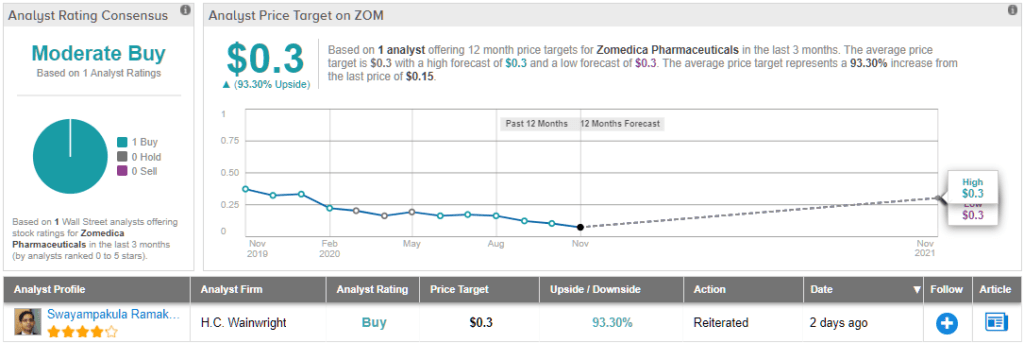

According to H.C. Wainwright analyst Swayampakula Ramakanth, there could be plenty more upside on the way.

Ramakanth reiterated a Buy rating on ZOM shares, although due to recent share dilution, the analyst slashed his price target from $0.5 to $0.3. Nevertheless, there’s still potential for 93% of gains from current levels. (To watch Ramakanth’s track record, click here)

So, what’s behind the surge? Namely the anticipated launch of Truforma.

Last Friday, the company announced it will launch the point-of-care (POC) diagnostic device for the detection of thyroid disease in dogs and cats and adrenal disease in dogs on March 30, 2021.

Ramakanthhas high hopes for the launch, noting: “We believe TRUFORMA has market potential since a POC diagnostic platform could save time for pet owners, while enabling veterinarians to build better relationships with clients by providing timely diagnosis and treatment.”

Additionally, the believes the upcoming launch is “the most important catalyst for the stock in the next six months.”

The veterinary market is already huge but is continuously expanding, and by 2027 it is estimated it could be worth over $29 billion. The veterinary diagnostics market on its own is expected to reach $4 billion by 2023.

For Truforma, Ramakanth estimates revenues could increase from $4 million in 2021 up to $53 million in 2030.

Right now, Zomedica’s focus is on the final development of the two initial Truforma diagnostic panels. The company is also readying for the launch, and has begun putting together its commercial team, which consists of a hybrid model incorporating professional service veterinarians, direct sales representatives, distributors, and distributor support representatives.

Ramakanth believes the strategy could yield strong results.

“We expect the hybrid commercial team of both distributors and direct sales force could generate synergy since distributors could provide initial sales channels through existing relationship, while direct sales could bring more control over the commercial team,” Ramakanth wrote.

As far as the company’s balance sheet is concerned, Zomdica saw out 3Q20 with $52 million of cash in the coffers, which Ramakanth believes “is sufficient to fund operations into the foreseeable future.”

Overall, Close’s is the only recent analyst review of this company, and it is decidedly positive. (See ZOM stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.