The FT is offering a free 30-day trial to Coronavirus Business Update, which includes access to FT.com. Please spread the word by forwarding this newsletter to friends and colleagues who you think would find it valuable. And if this has been forwarded to you, hello. Please sign up here

Latest news

For the latest coronavirus news, visit our live blog

Moderna files for US and EU vaccine approval

Moderna plans to submit its Covid-19 shot for regulatory approval in the US and the EU on Monday, making it the second western vaccine maker on track to start distribution in December.

The Boston-based biotech group released new trial data on Monday. It showed an efficacy rate of 94.1 per cent and no serious safety concerns. Earlier this month, the group released the first set of results from its clinical trials, involving 30,000 participants, using its groundbreaking approach to vaccine development.

“Ninety four per cent of people we have [develop] no disease, no symptoms . . . Those who get it will be very, very mild and so you will almost stop, if not entirely stop, hospitalisation and death,” said Stéphane Bancel, Moderna’s chief executive.

In addition to filing for approval in the US and EU, Moderna says it will send the same trial data to regulators where it is already under rolling review, including in the UK.

A rival vaccine developed by US pharmaceutical company Pfizer and BioNTech of Germany has already been submitted for approval by US authorities. The US Food and Drug Administration could grant consent as early as December 8, according to US media reports.

The UK is expected to start using the Pfizer-BioNTech vaccine even earlier. The independent UK regulator is set to grant approval within days, according to government officials.

The European Medicines Agency, which licenses medicines across the EU, is set to consider next month whether to approve the Pfizer-BioNTech vaccine as well as the Moderna jab, according to confidential documents seen by the Financial Times.

Approval next month from the EMA would pave the way for the EU’s 27 member states to start inoculations before the end of the year.

The EMA has been under pressure to accelerate the process because the UK and US are likely to approve a vaccine sooner, according to people familiar with the agency’s process.

Regulators are facing pressure to balance the overwhelming public health need with the imperative of ensuring trust in the approval process, which is being clouded by online disinformation. UK public health experts are worried anti-vaxxers are making incursions into the mainstream.

Markets

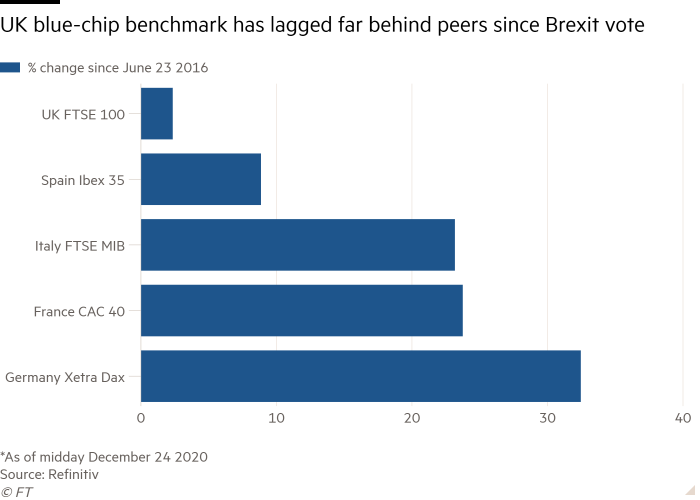

Investors have been rotating out of tech stocks and into sectors likely to benefit most from a quick end to the health and economic crisis. UK stocks are on track for their best month in more than three decades after a rally powered by Covid-19 vaccine breakthroughs. On Wall Street, the S&P 500 was also heading for a strong month, up more than 10 per cent in November, its best monthly performance since April. The dollar is on course for its worst month since July.

It is hard to find a market analyst who diverges from the forecast that after a few testing months, economic recovery in 2021 will be powered by vaccines and ultra-easy monetary policy. But Robin Wigglesworth, global finance correspondent, has some deliberately (if only slightly) contrarian suggestions for where financial markets could surprise the consensus in the coming year.

Equities are on heady valuations, writes John Plender. In the short term the market will toss and turn in response to coronavirus and vaccine news. With fund managers’ cash holdings now back down to pre-coronavirus levels, according to the Bank of America global fund managers’ survey, a wobbly period may be due. But long-term investors should sit it out. News on fiscal policy will probably improve and a recovery is undoubtedly coming.

Business

Meituan, one of China’s largest food delivery companies, on Monday said sales rose by a third in the three months to September as the country brought the pandemic under control and consumers returned to ordering groceries online. Meituan, which employs 4m drivers and has a market value of $220bn, struggled at the beginning of the pandemic as orders dried up and restaurants closed.

ABN Amro, the Dutch bank majority controlled by the state, is to reduce staff numbers by 2,500 — or 15 per cent — over the next few years to cut costs and “future proof” the business, it said on Monday. As part of plans to save €700m, the bank will close branches, increase digitalisation and wind down part of its investment bank.

About half the usual number of shoppers visited US retailers on Black Friday — what should be one of their busiest days of the year — deepening the crisis at bricks-and-mortar chains already ravaged by the pandemic. Data released this weekend by RetailNext, which analyses video, and also Sensormatic Solutions, which uses movement sensors, both showed traffic levels across the country dropped about 50 per cent year on year. Digital spending, however, surged.

Global economy

The coronavirus crisis has resulted in a sharp increase in poverty and low incomes across the UK, according to two independent think-tank reports published on Monday. The Legatum Institute found that the number of people living in poverty had risen almost 700,000 to 15.2m this year as a result of the pandemic’s impact on jobs, wages and profits. The New Economics Foundation warned that a third of the UK’s population would be living below the minimum socially acceptable standard of living by next spring under current government policy.

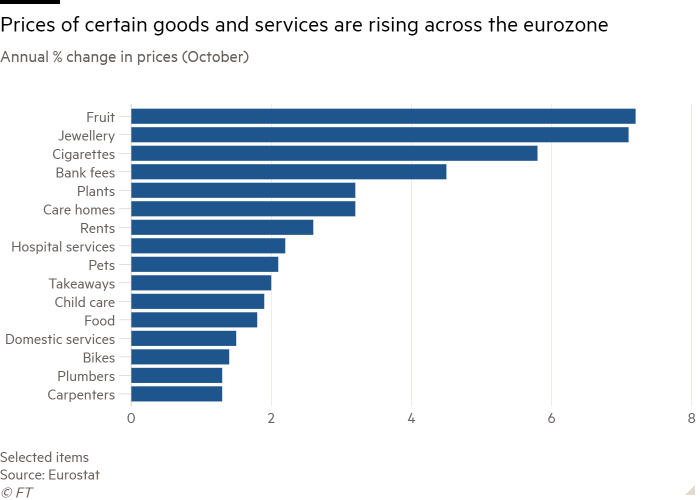

The cost of many goods and services, which have become popular with eurozone consumers during the pandemic, is rising far faster than the bloc’s overall depressed level of inflation, according to an analysis of official data by the FT. The prices of significant regular budget items such as food and medical services are increasing by about the ECB target inflation rate of just below 2 per cent despite falls in the overall rate of inflation.

This year’s surge in borrowing to cover the cost of the pandemic has been called the largest wave in a great “debt tsunami”. It provided a “bridge” over the collapse in world output, corporate bankruptcies and economic hardship for households. But in light of the progress on vaccines, investors can be more confident that the end of the debt bridge is in sight, writes Gavyn Davies.

Have your say

Coronavirus vaccines mean light at the end of the tunnel at last. But there’s a long way to go before the world can say goodbye to pandemic disruptions. Can governments roll out vaccine programmes swiftly, efficiently and fairly? And who should have priority? Please share your views with us — email us at covid@ft.com. Thanks.

123 Beer St responds to the article Remote work: how are you feeling?

I’m not very sociable. I don’t do office gossip and don’t enjoy the parties and find doing presentations in meetings, at conferences, etc uncomfortable. I can work from home just fine and lockdown hasn’t cost me or my business a penny. But even I am now hating this.

The essentials

Are you experiencing pandemic burnout at work? We are exploring the impact of the pandemic on people’s work life and want to hear from readers. Tell us about your experiences of working during the pandemic in this short survey. We plan to publish a selection of responses in the FT.

People who torpedo meetings with an assortment of irksome behaviour, the remorselessly off-topic grandstander, the dominating drone or the rude multitasker are all examples of the meeting monster that have thrived during the pandemic, says Pilita Clark. Research showed there were an estimated 55m meetings a day in the US alone before the pandemic. “I dread to think what the figures look like now that Covid-19 and remote working have ushered in the age of the perpetual meeting,” she writes.

Final thought

There’s a certain romance to the idea of a bespoke scent: the complexities of a character aromatically expressed. Generally they are the preserve of niche perfumers, but now luxury megabrand Louis Vuitton is aiming to take the trial and error out of finding that dream olfactory match with its new custom-tailored fragrance service. From a mere €60,000.

We would really like to hear from you. Please send your reactions or suggestions to covid@ft.com. Thanks