In the first week of September, the markets saw a sudden drop from peak values. That fall was most pronounced in the NASDAQ index, which dropped from 1,200 points – some 10% – in just 5 trading sessions. Since then, however, the situation has stabilized. Stocks have bounced up and down, but the NASDAQ has generally held steady at or near 11,000 for the past three weeks.

The holding pattern is likely more important than the slide. It’s lasted longer, and appears to represent a classic market correction. The NASDAQ’s 5-month run to its September 2 all-time high left it somewhat overvalued, and it’s now fallen back to a more sustainable level. This is borne out by a look at three major components of the index, members of tech’s ‘FAANG’ club.

The FAANG stocks are Facebook, Amazon, Apple, Netflix, and Google (Alphabet). They are the 800-pound gorillas of the tech world, companies of enormous size and scope, whose operations and market fluctuations have been a major driver to the NASDAQ, and the overall stock market, in recent years. And three of them have another important point in common, too: each gets a ‘Perfect 10’ rating from the TipRanks Smart Score.

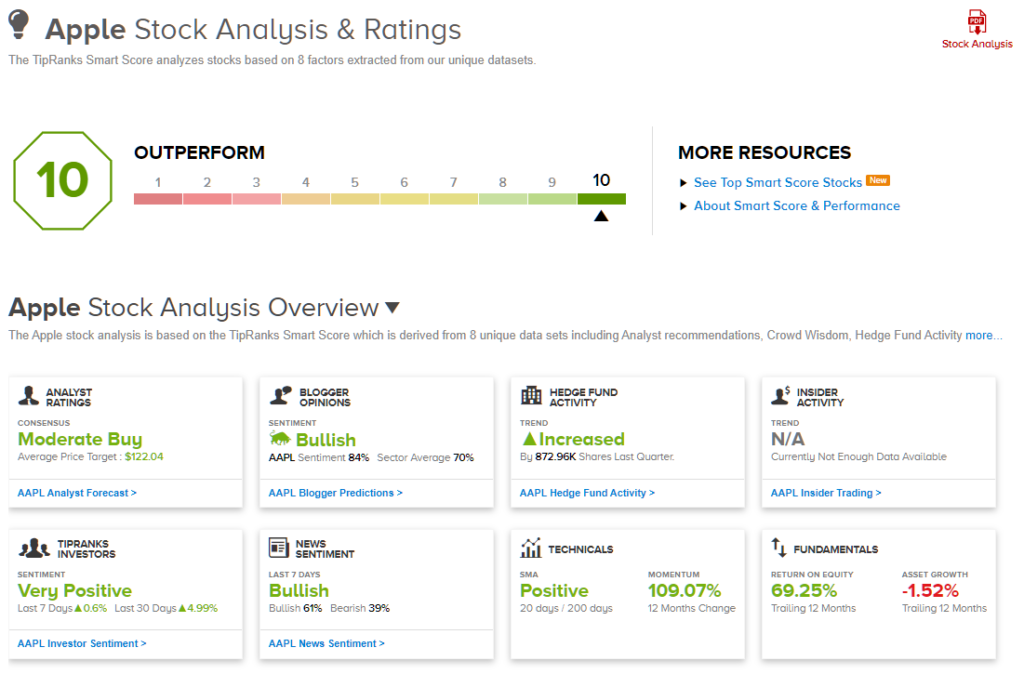

The Smart Score rates every stock according to set of 8 factors that have historically correlated with future outperformance, and combines them into a simple 1 to 10 scale to indicate the stock’s likely future course.

Now let’s see why these tech giants scored so highly, and what Wall Street’s analysts have to say about it.

Facebook (FB)

First on our list is Facebook. The social media giant has spawned both an industry and much controversy in the years since it burst on the scene. In recent years, Facebook has come under fire for advertising policies, privacy breaches, and accusations of censorship – but none of that has halted the long-term growth of the stock.

The company makes its money selling advertising, using AI tracking algorithms to monitor account activity and create perfectly target ads. It’s a system that has introduced us, in less than one generation, to impressions, banner ads, and pay-per-click. It has changed the way we do business online.

With the election coming up, Facebook is not shying away from controversial actions. The company has announced that it will ban political ads in the week before election day, as well as censor groups deemed to promote violence or spread false information about the corona pandemic. Intended to be politically neutral, these moves have drawn criticism from side of the political arena.

That has not stopped Facebook from raking in the money, however. Earnings did fall 33% sequentially in the first quarter of this year – but that should be put in perspective. FB’s pattern is to register its best results in Q4 (holiday advertising), and its lowest results in Q1. With that in mind, it’s more important that, during the ‘corona quarter,’ Facebook’s Q1 EPS were up 101% year-over-year. Results in Q2 were almost as impressive, with the $1.80 EPS being up 97% year-to-date.

Looking at Facebook’s near-term prospects, 5-star analyst Mark Zgutowicz of Rosenblatt Securities see plenty of reason for optimism. Zgutowicz admits that consumers may develop a ‘spending fatigue’ in the wake of anti-COVID stimulus bills, but “given Facebook’s immense exposure to ecommerce with now 9M active small business advertisers, and the holiday season soon approaching,” the analyst believes “any stimulus spend fatigue will be offset [by] escalating ecommerce trajectory.”

In line with these comments, Zgutowicz rates FB a Buy and sets a price target of $325. This target implies room for 24% share appreciation in the next year. (To watch Zgutowicz’s track record, click here)

Overall, Facebook’s Strong Buy consensus rating is based on 38 recent reviews, with a breakdown of 33 Buy, 4 Hold, 1 lonely Sell. The shares are priced at $261.90 and have an average price target of $295.82, suggesting a 13% upside from current levels. (See FB stock analysis on TipRanks)

Amazon.com (AMZN)

Next up, Amazon, is the market’s second largest publicly traded company, with a market cap of $1.59 trillion and a famously high share price exceeding $3,000. Amazon has proven a master of self-reinvention since the late ‘90s, starting out as an online book seller and surviving the doc.com bubble to become, now, the world’s largest online retailer, where customers can buy everything from buttons to brie, and even books.

Looking at Amazon’s performance, the most immediate salient factor is the steady rise in share value over the years. Under Jeff Bezos’ leadership, Amazon does not pay out a dividend or conduct share buybacks; investors benefit solely from share appreciation. And that appreciation has been substantial, especially for long-term investors. Just in the last five years, the stock has grown over 480%.

The company has achieved this growth by taking advantage of every opportunity that comes its way – when it is not inventing those opportunities. The corona crisis was no exception to this pattern; as the social lockdown policies kept people home and closed down stores and shops, Amazon’s service became essential. Customers could order anything, and have it delivered. The company’s 2Q20 revenues reflect this success; coming in at $88.9 billion, they were up 40% year-over-year. Earnings also showed how Amazon thrived under the new conditions. Q1 results had been in-line with the previous six quarters – but in Q2, EPS jumped to $10.30, far ahead of the $1.74 estimate.

In his coverage of Amazon stock, JMP’s 5-star analyst Ronald Josey notes the perfect fit of the company and the times.

“The COVID-19 pandemic has clearly pulled forward eCommerce adoption by at least three years, in our view, and Amazon’s investment in its product selection and delivery network—which continues to improve—was on display this quarter. Beginning in mid-April, demand expanded beyond essentials to a more normalized mix of hardlines and softlines, and newer services like grocery delivery tripled. Overall, we believe 2Q’s execution and ability to launch newer products and services highlights Amazon’s strength as an organization,” Josey opined.

Josey rates Amazon as Outperform (i.e. Buy), and his price target, at an eye-opening $4,075, suggests 29% growth for the next 12 months. (To watch Josey’s track record, click here)

Overall, the Strong Buy consensus rating on Amazon is, unsurprisingly, unanimous, based on no fewer than 37 positive reviews. The share price comes in at $3,149, and the average price target of $3,732 implies an 18.5% one-year upside potential. (See AMZN stock analysis on TipRanks)

Apple, Inc. (AAPL)

And now we come to Apple, the single largest component of the NASDAQ, making up over 13% of the index by weight. It is also the largest publicly traded company in the world. Two years ago, in summer 2018, Apple was the first company to ever exceed $1 trillion in market cap, and earlier this year, Apple broke above $2 trillion. The company is currently valued at $1.98 trillion.

A big advantage for Apple, as the corona crisis took hold, was that the company had entered 2020 on the heels of record-breaking fourth quarter results. Apple’s Q4s are typically the company’s best, boosted, by holiday sales, and 4Q19 gave Apple a financial kick right before the sales depression of 1Q20 hit. By 2Q20, Apple’s EPS was down to just 64 cents, well below the $2.03 forecast. Revenues, however, remained at $60 billion, roughly in-line with Apple’s historic mid-year quarterly performance.

Looking ahead, Apple has at least two more major advantages going forward. First, the company will be releasing its 5G-compatible iPhone 12 line this fall. And second, at least one-third of Apple’s installed iPhone user base will be entering the natural device replacement cycle over the next year.

JPMorgan analyst Samik Chatterjee reviewed Apple, and sums all of the above in clear prose: “…investors have widely acknowledged the rich valuation of AAPL shares. While the $2 trn market cap valuation in itself is a significant milestone, that AAPL shares crossed it in a year with significant COVID-19 disruption testifies to the recurring nature of not only its Services, but also its Products, such that investors are now willing to pay a Services-like premium on the entire earnings stream and a modest premium on account of expectations for further revenue/earnings upside. While we acknowledge that the valuation is no longer an easy entry point into the shares, at the same time, potential upside revenue/earnings drivers as well as upcoming catalysts will make it difficult for investors to step away from the shares.”

To this end, Chatterjee puts a $150 price tag on AAPL shares, implying an upside of 29% and backing his Overweight (i.e. Buy) rating. (To watch Chatterjee’s track record, click here)

All in all, Apple holds a Moderate Buy rating from the analyst consensus, with 35 reviews breaking down to 24 Buys, 8 Holds, and 3 Sells. The shares are selling for $115.81 and have an average price target of $122.04. This suggests a modest 5.5% upside from current levels. (See Apple stock analysis at TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.