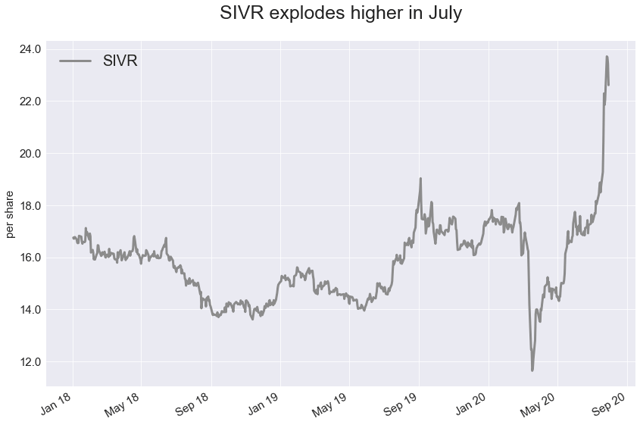

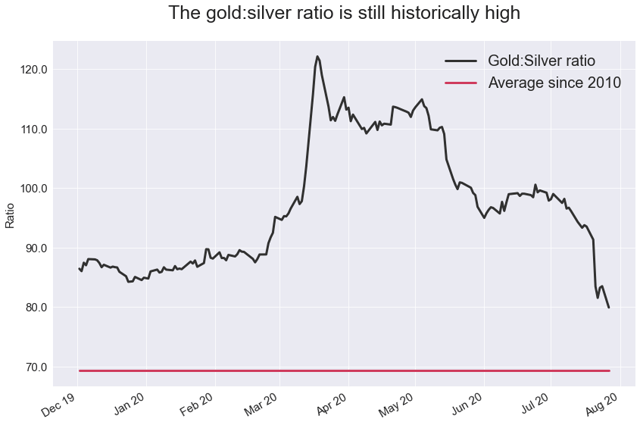

The Aberdeen Standard Physical Silver Shares ETF (NYSEARCA:SIVR) rallied by more than 30% in July, its largest monthly gain ever!

Source: Bloomberg, Orchid Research

About SIVR

SIVR is an ETF product using a physically-backed methodology. This means that SIVR holds physical silver bars in HSBC vaults.

The physically-backed methodology prevents investors from getting punished by the contango structure of the Comex silver forward curve (forward>spot), contrary to a futures contract-based methodology.

For long-term investors, SIVR seems better than its competitor SLV, principally because its expense ratio is lower (0.30% for SIVR vs. 0.50% for SLV), which is key to make profit over the long term.

Retail buying frenzy

To a stronger extent than gold, silver has benefited from the buying frenzy among retail investors. Silver ETFs tend to be dominated by retail investors, whereas gold ETFs tend to be dominated by professional investors. The silver buying frenzy among the retail community was evident in the Robinhood platform, in which SLV became one of the most popular picks among traders.

Source: Robinhood

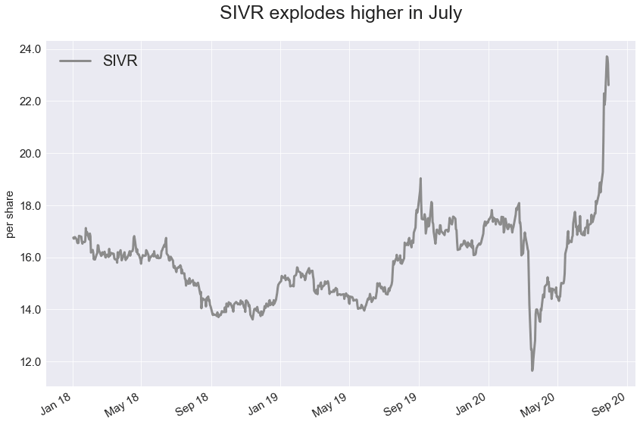

Like gold, silver has benefited from a massive increase in investment demand due to the decline in the dollar and the fall in short-term real interest rates. Our work shows that silver investment demand is more sensitive to changes in short-term real interest rates (five-year US TIPS yield) than long-term rates (30-year US TIPS yield). Take a look at the dollar and the five-year US TIPS yield:

Source: Bloomberg, Orchid

Given the contraction in industrial output this year, it could be puzzling to understand why silver prices have outperformed gold prices significantly since Q2. We see two factors.

Factor #1: Retail buying interest

Because the silver market is smaller than the gold market, the participation of retail investors could have a more significant impact on silver prices.

Factor #2: Lighter spec positioning

While net long speculative positions in CME gold are near an all-time high, net long speculative positions in CME silver are significantly below their all-time high. Because the positioning in the silver futures market is lighter, there is more dry powder among the speculative community to deploy on the long side.

Outperformance of silver prices set to continue

Silver prices have outperformed gold prices in recent months, which corroborates our thesis. We think that the outperformance of silver could continue for two reasons.

First, global industrial production is expected to recover incrementally in the months ahead after the big plunge in the first half of the year. This could, therefore, boost silver usage in the near term.

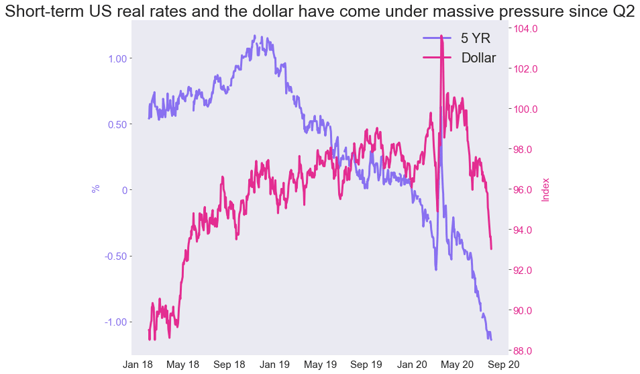

Second, silver is still relatively cheap relative to gold after its marked underperformance in Q1. A simple way to visualize this is to look at the gold:silver ratio.

Source: Bloomberg, Orchid Research

Commodities tend to follow mean-reverting processes. After overshooting above its average, we think that the gold:silver ratio will converge toward its average since 2010 (~70) and undershoot below it.

We expect SIVR to move still higher in the second half of the year, with silver prices likely to outperform gold prices.

Note of caution

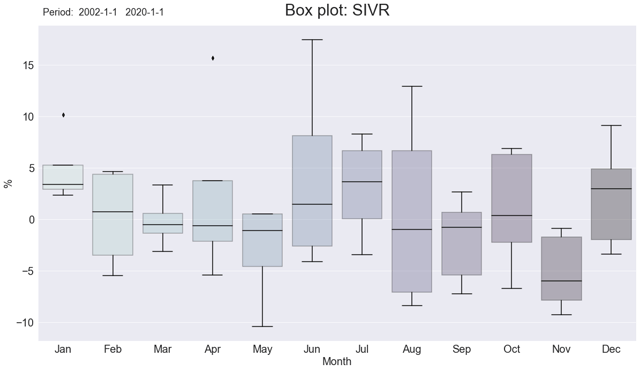

After a stellar performance in July, SIVR could be vulnerable to some profit-taking in August. This is especially true considering that the seasonality of SIVR turns unfriendly in August, with a high dispersion of returns.

Source: Bloomberg, Orchid Research

Bottom line: A “buy on the dips” strategy could be interesting to implement.

Did you like this?

Click the “Follow” button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.