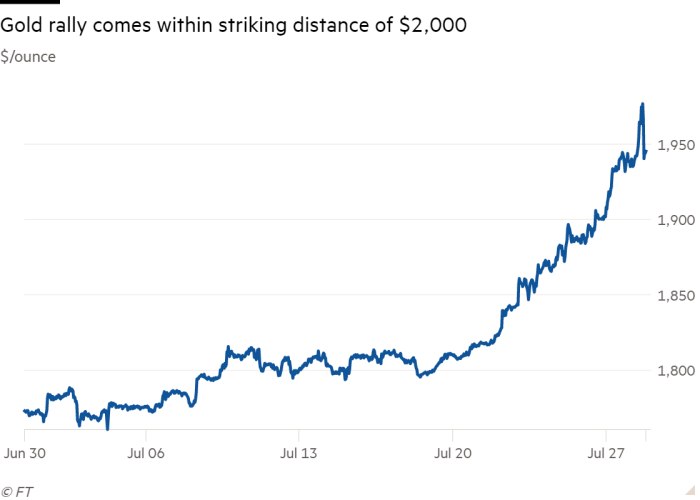

The price of gold dropped more than 3 per cent in the first hours of London trade, with investors taking profit after the precious metal rose to within striking distance of $2,000 for the first time.

The spot gold price increased as much as 2 per cent to hit a new all-time high of $1,980.57 per troy ounce on Tuesday morning in Asia, before falling back sharply in the London session to $1,909.

Silver also rose as much as 6.4 per cent to $26.19 per ounce during the Asian session, before tumbling to $22.32.

The volatility in precious metals reflected conflicting views about the US economy and monetary policy decisions ahead of the next Federal Reserve meeting on Wednesday.

While traders generally doubt the Fed will turn to negative interest rates, some believe it could adopt more unconventional measures such as yield curve control or setting upper limits on Treasury yields.

Negative returns for US and other government bonds, after accounting for inflation, has boosted the allure of gold, which is considered to be a store of value and a hedge against future inflation.

“Growing safe haven demand amid significant uncertainties, falling real yields, rising inflation expectations, rightly or wrongly, as well as momentum buying have all supported this latest move higher” in gold, said Warren Patterson, head of commodities strategy at ING.

On Tuesday, analysts at Citi raised their price target for gold to $2,100.

But while the gold price has risen by about 12 per cent since early May, its rally paused on Tuesday as the dollar began recovering from a rout.

Traders have dumped the US currency in recent days because of a surge in coronavirus cases in sunbelt states and a stalemate between the White House and Congress on approving new stimulus for the struggling US economy.

The sell-off eased on Tuesday, however, as investors awaited the Fed’s latest policy decision. The index tracking the dollar against a basket of trading partners’ currencies hit a two-year low of 93.492 in the Asian trading session before bouncing back to 93.958 just after 9am in London.

The euro also fell from a two-year high reached on Monday, down 0.3 per cent at $1.713.

In Europe, London’s FTSE 100 opened 0.7 per cent higher, propelled upwards by energy stocks that investors hope will benefit from more US stimulus to battle the coronavirus pandemic. The Europe Stoxx 600 index rose 0.2 per cent, Germany’s Dax gained 0.4 per cent and France’s CAC lost 0.2 per cent.

This followed a mixed session in Asia. China’s CSI 300 index of Shanghai and Shenzhen-listed stocks climbed 0.5 per cent while Hong Kong’s Hang Seng rose 0.4 per cent. Japan’s benchmark Topix shed 0.5 per cent.

Futures tipped Wall Street’s S&P 500 to rise 0.1 per cent when trading begins later.