Municipal market technicals were already driving performance and so the strong quality bid has deepened the rally across the curve as the asset class really didn’t need to grab U.S. Treasuries coattails all that tightly.

Jeffery Lipton, managing director, head of muni research and strategy at Oppenheimer, said that the outsized demand for U.S. sovereign debt can explain the year-to-date underperformance of munis versus UST throughout the coronavirus-driven bond market rally.

“We suspect that when sentiment shifts, munis are poised to outperform the selloff,” Lipton said. “Munis have been booking solid gains even without the quality trade, driven by the inability of market supply to keep pace with outsized demand for product, and a particularly unique set of circumstances that have elevated the issuance and investor appeal of taxable municipal bonds; any sustained disruption in the pace and/or direction of fund flows could ignite a market correction of material magnitude given the currently low base level of yields.”

With COVID-19 fears at an all-time high, there is talk of the Fed making an emergency cut to interest rates, to try and help the markets.

“We see continued demand as a primary driver of performance, and whether or not the Fed eases policy, muni yields are likely to stay at or within range of these historically low levels,” Lipton said. “Throughout the near-term, we are likely to continue the risk-on/risk-off cycle, which could introduce some interesting buying opportunities.”

Secondary market

Munis were mixed on Thursday on the MBIS benchmark scale, with yields rising three basis points in the 10-year maturity and falling one basis point in the 30-year maturity. High-grades were also mixed, with yields on MBIS’ AAA scale increasing by two basis points in the 10-year maturity and decreasing by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO was four basis points lower to another record of 0.94% and the 30-year muni GO was down five basis points to a new record low of 1.52%.

The 10-year muni-to-Treasury ratio was calculated at 75.0% while the 30-year muni-to-Treasury ratio stood at 87.6%, according to MMD.

Stocks are on pace to have the worst week since the 2008 financial crisis. The market sell off is now on its sixth day, all due to growing fear of COVID-19 as the virus continues to spread rapidly across the globe and county.

The Dow Jones Industrial Average was down about 3.42%, the S&P 500 index was lower by 3.38% and the Nasdaq lost roughly 3.57% late in the session Thursday.

The three-month Treasury was yielding 1.449%, the Treasury two-year was yielding 1.086%, the five-year was yielding 1.086%, the 10-year was yielding 1.296% and the 30-year was yielding 1.791%. Both the 10- and 30-year USTs hit new all-time lows, before ticking back up.

“This largely unexpected spread of COVID-19 sparked a stock market plunge that by Tuesday’s close had shaved nearly 2,500 points off the Dow’s record high from just two weeks earlier,” said an economic and municipal commentary from Hilltop Securities’ Scott McIntrye, managing director and asset management, and senior portfolio manager, Greg Warner, director and senior portfolio manager and Tom Kozlik, head of muni strategy and credit.

“There’s a massive range of outcomes to the virus threat,” the report said. “A number of individual Fed speakers last week downplayed the threat, characterizing the virus as ‘likely to be a short term disruption,’ ‘not a point of concern,’ and a ‘high probability of only a temporary shock.’ The Fed wants all this to be true. They don’t want to cut rates again unless they absolutely have to.”

Primary market

The last deals of the week priced into an even stronger market.

Barclays priced the Regents of the University of California’s (Aa3/AA-/AA-/ ) $1.8 billion of medical center pooled revenue taxable bonds. The deal was upsized by $300 million from its original par amount of $1.5 billion.

“The market is very rough right now,” said one New York taxable trader. “The demand for the 2040s was two to three times over so they upsized from $500 million to $650 million and it was a similar case for 2050s, as it was upsized from $500 million to $850 million.

He added that the 100-year bonds were reduced from $500 million to $350 million.

“Overall, the deal saw strong demand, yes,” he said. “They were cheapened 15 to 25 basis points, which helped.”

Bank of America Securities priced the University of Washington’s (Aaa/AA+/ / ) $224.030 million of general revenue taxable and delayed delivery bonds.

RBC Capital Markets priced the State of New York Mortgage Agency’s (Aa1/ / / ) $147.605 million of revenue alternative minimum tax and non-AMT bonds.

Competitively, the Florida Department of Transportation sold $193.45 million of turnpike revenue refunding bonds, won by BofAS with a true interest cost of 1.7566%.

Also, Baltimore County (MIG1/SP-1+/F1+/ ) soldshort-term notes after selling consolidated public improvment bonds yesterday.

The county first sold $205 million of bond anticipation notes, which were won by UBS with a net interest cost of 0.8353%, Morgan Stanley with a NIC of 0.8362, JP Morgan with a NIC of 0.8392 and BofAS with a NIC of 0.8401%.

Then it sold $145 million of consolidated public improvement BANs, which were won by Morgan Stanley with a NIC of 0.8343 and BofAS with a NIC of 0.8353%.

“As long as rates stay low with the right curve bias and spread relationships, we do not expect the taxable muni build to dissipate anytime soon as issuers work within the constraints of the Tax Cuts and Jobs Act, and seek to advance refund outstanding tax-exempt bonds,” Lipton said. Even though taxable munis are having their day in the sun, the refunding and new-issue economics are not likely to endure forever as the spread between both taxable and tax-exempt rates will, at some point, revert back to historical norms. But we do concede that this reversion point is not yet on the horizon.”

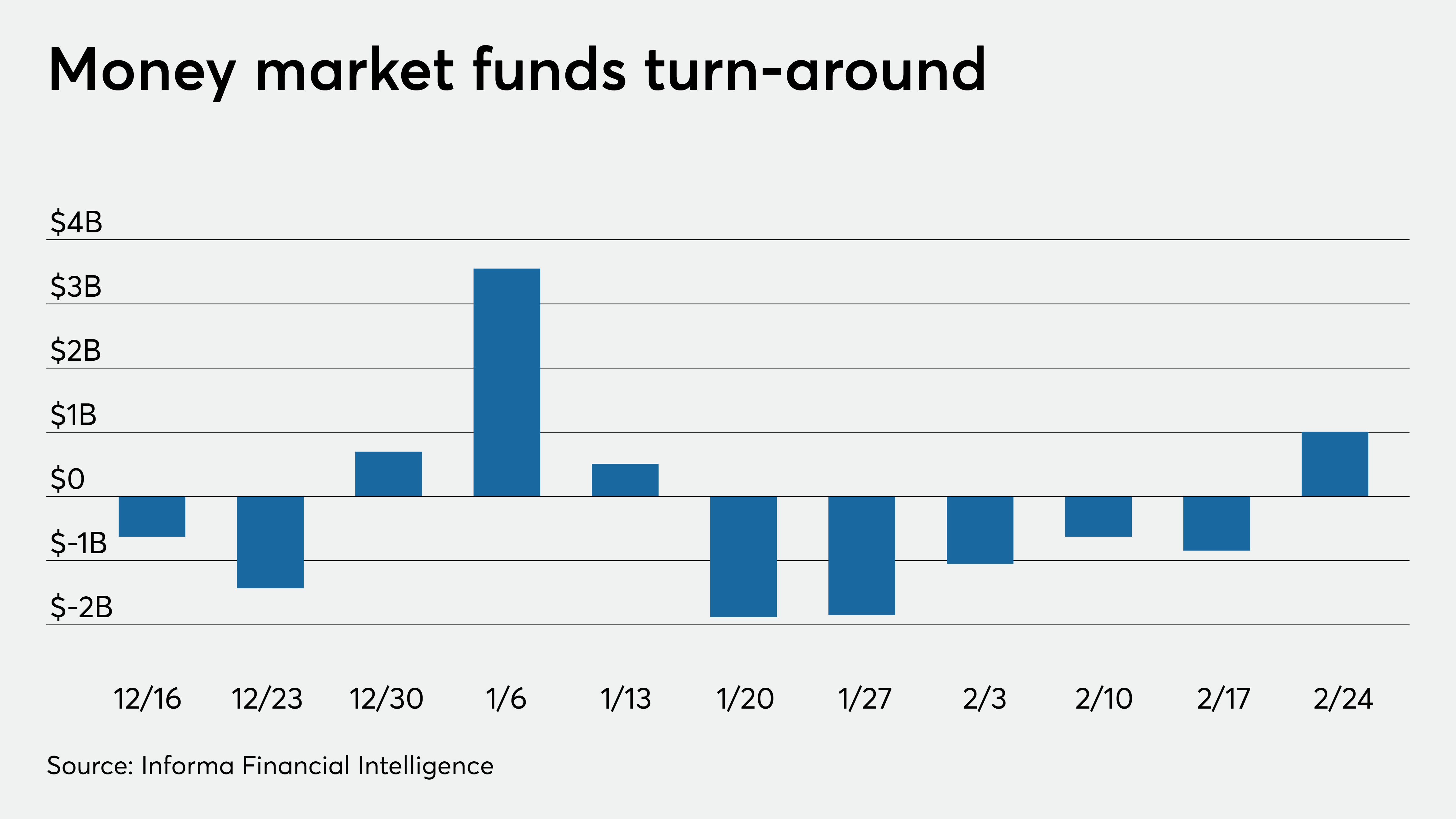

Muni money market funds see inflows

Tax-exempt municipal money market fund assets increased by $1.01 billion, raising their total net assets to $135.92 billion in the week ended Feb. 24, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield

for the 187 tax-free and municipal money-market funds increased to 0.74% from 0.69% in the previous week.

Taxable money-fund assets were up $12.60 billion in the week ended Feb. 25, bringing total net assets to $3.453 trillion. The average, seven-day simple yield for the 797 taxable reporting funds was unchanged from 1.25% the prior week.

Overall, the combined total net assets of the 984 reporting money funds decreased $13.61 billion to $3.589 trillion in the week ended Feb. 25.

Bond Buyer indexes plunge

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, sunk nine basis points to 3.41% from 3.50% the week before.

The Bond Buyer’s 20-bond GO Index of 20-year general obligation yields was plumented 19 basis points to 2.27% from 2.46% the week before.

The 11-bond GO Index of higher-grade 11-year GOs descended 19 basis points to 1.80% from 1.99% the prior week.

The Bond Buyer’s Revenue Bond Index was down 19 bsis points to 2.77% from 2.96% from the previous week.

The yield on the U.S. Treasury’s 10-year note fell to 1.30% from 1.52% the week before, while the yield on the 30-year Treasury was lower to 1.80% from 1.97%

Previous session’s activity

The MSRB reported 34,569 trades Wednesday on volume of $23.220 billion. The 30-day average trade summary showed on a par amount basis of $12.39 million that customers bought $6.32 million, customers sold $3.96 million and interdealer trades totaled $2.11 million.

Ohio, California and Texas were most traded, with the Buckeye State taking 14.838% of the market, the Golden State taking 12.756% and the Lone Star State taking 11.577%.

The most actively traded security was the Buckeye Tobacco Settlement Financing Authority’s senior refunding bonds 2020 B-2 CL 2, 5s of 2055, which traded 134 times on volume of $361.380 million.

The series 2020A-2 Class 1 senior current interest bonds saw lots of secondary trading activity on Wednesday.

The 2030 maturity was originally priced as 5s to yield 1.48%. Based off of 16 trades that took place Wednesday, traded at a high yield of 1.480%, a low of 1.280% and a average yield of 1.455%.

The long bond (2048 split maturity), with the first half priced as 3s to yield 2.90%. Based off of 54 trades on Wednesday, the high yield was 2.900%, the low was 2.420% and the average was 2.808%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.